Understanding the Goods and Services Tax (GST) and its components, specifically the Central Goods and Services Tax (CGST), can be confusing when it comes to car servicing. This article will break down what CGST is, how it applies to car service, and what you need to know as a consumer or business owner in the automotive industry.

Car servicing is subject to GST in India. This means that when you get your car serviced, a portion of the total bill goes towards GST. This GST is further divided into CGST and SGST (State Goods and Services Tax). Knowing how these taxes are calculated can help you better understand your car service bill and budget accordingly. You might be wondering, what even necessitates these taxes in the first place? For a deeper understanding, check out why sgcst and cgst for car service.

Understanding CGST and its Application to Car Service

CGST is the central government’s share of the overall GST levied on goods and services. It is collected by the central government and is a crucial source of revenue. For car service, the CGST rate is currently 9% (as of 2023, this is subject to change and should be verified with current regulations), meaning 9% of the taxable value of your car service bill will be paid as CGST.

How is CGST Calculated for Car Service?

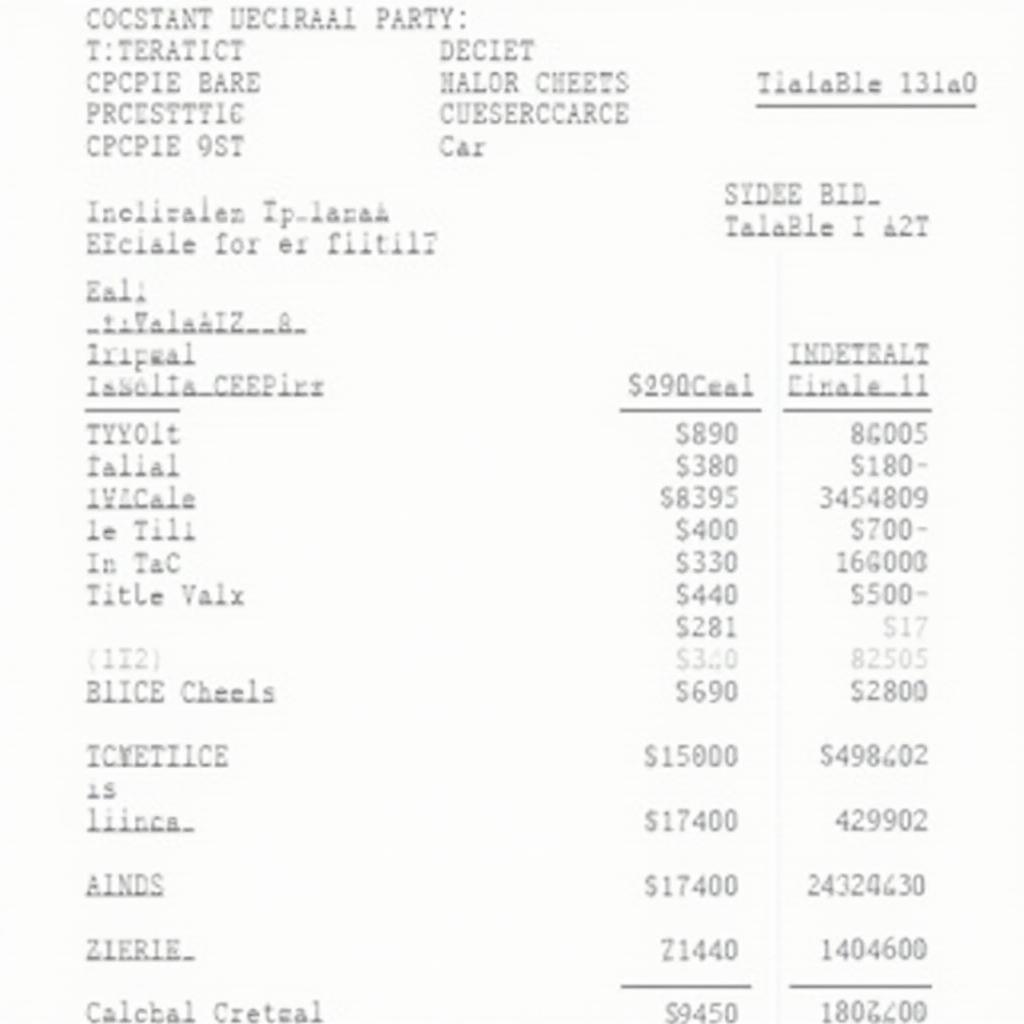

The calculation is fairly straightforward. First, the total taxable value of the service is determined. This includes the cost of labor, parts, and any other taxable components. Then, 9% of this value is calculated as CGST. This amount is then added to your final bill.

Example of CGST Calculation for Car Service

Example of CGST Calculation for Car Service

Decoding Your Car Service Bill: GST Components

Your car service bill will usually list the GST components separately. You should see both CGST and SGST listed, each at 9%, totaling 18% GST. Understanding these components helps you ensure you’re not being overcharged. For more information about the broader topic of GST on car service, you can visit what is gst for car service.

Why is Understanding CGST Important?

Knowing about CGST isn’t just about understanding your bill. It’s about understanding the tax system and your contribution to it. This knowledge can also be useful for businesses offering car services, as they need to accurately calculate and collect GST.

Impact of CGST on Car Service Costs

The inclusion of CGST, along with SGST, directly impacts the overall cost of car servicing. While it contributes to government revenue, it also increases the expense for car owners.

Managing Car Service Costs in the Context of GST

While you can’t avoid paying GST, understanding it can help you budget effectively and avoid surprises. Regular car maintenance can also help prevent major repairs down the line, potentially minimizing future GST expenses. Wondering why regular servicing is so crucial? Explore more about the benefits of regular car maintenance at why service a car.

Expert Insights on CGST and Car Service

“Understanding the tax implications of car servicing is vital for both consumers and businesses. Transparency in billing and a clear understanding of CGST and SGST calculations fosters trust and ensures fair practices within the automotive industry,” says automotive expert, Anika Sharma, Senior Tax Consultant at AutoTax Solutions.

“Consumers should always verify the GST rates applied to their car service bills. Keeping up-to-date with current regulations ensures accurate calculations and avoids any potential discrepancies,” adds Rajeev Patel, Managing Director at Patel Automotive Group.

Conclusion

CGST is an integral part of the GST levied on car service in India. Understanding how it’s calculated and its impact on your final bill empowers you to make informed decisions about car maintenance and budgeting. By grasping the basics of CGST, you can navigate the car servicing landscape with greater clarity and confidence.

FAQs

- What is the current CGST rate for car service? (9% as of 2023, subject to change)

- What is the difference between CGST and SGST? (CGST goes to the central government, SGST to the state government)

- Is GST applicable to all car services? (Yes, GST is applicable to most car services)

- How can I verify the GST charged on my car service bill? (Check the bill for separate CGST and SGST amounts)

- Can I claim input tax credit on CGST paid for car service? (This depends on the specific circumstances and whether you are a registered business)

- What happens if the car service provider doesn’t charge GST? (This could indicate non-compliance and should be reported)

- Where can I find more information about GST on car services? (Consult the GST website or a tax professional)

For further assistance, please contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our customer service team is available 24/7.