Understanding Goods and Services Tax (GST) on car services is crucial for both car owners and service providers. This article will delve into the specifics of GST as it applies to car servicing, covering everything from the applicable rates to claiming input tax credits. You’ll gain a comprehensive understanding of how GST impacts your car maintenance expenses. Let’s dive right in.

Decoding GST on Car Services

GST, a comprehensive indirect tax levied on the supply of goods and services, also applies to car services. The GST rate for car services in most countries is a standard rate, but it can vary depending on the specific service rendered. Knowing what constitutes a “car service” under GST law is essential for proper tax compliance. This includes regular maintenance like oil changes, repairs like replacing brake pads, and even aesthetic services like detailing. how much gst on car service will provide you with a better understanding of the prevailing rates.

Knowing the specifics of GST on car service allows you to budget effectively and avoid any surprises when settling your bill. For car service providers, understanding GST is paramount for accurate invoicing and tax filing.

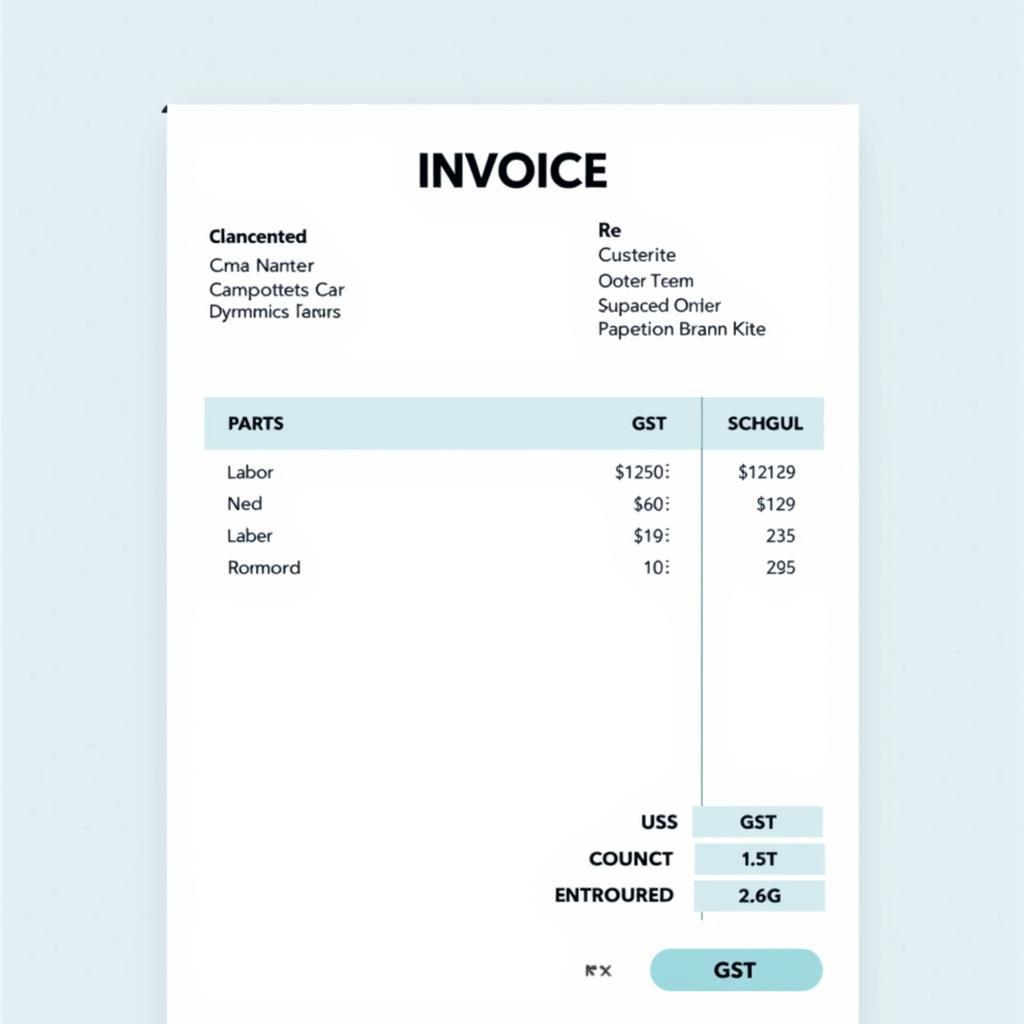

How is GST Calculated on Car Service?

The GST calculation for car service is generally straightforward. The applicable GST rate is applied to the total value of the service provided. This includes the cost of parts, labor, and any other charges associated with the service. It’s important to note that different services might fall under different GST slabs. For instance, the rate for repair work might be different from the rate applied to car washing or detailing services. For a comprehensive understanding of the input tax credits related to car maintenance, check out can we clam gst input on car maintenance services.

Understanding how GST is calculated allows transparency and allows you to verify the accuracy of your invoices. For businesses, this ensures compliant invoicing and avoids potential issues with tax authorities.

What Car Services are Covered Under GST?

A wide array of car services falls under the purview of GST. This includes routine maintenance such as oil changes, filter replacements, and tire rotations. Repair services like engine overhauls, brake repairs, and bodywork also attract GST. Additionally, even value-added services such as car detailing, paint protection, and interior cleaning are subject to GST.

This broad scope ensures uniformity in taxation across the car service industry. This clarity benefits both consumers and service providers.

GST Implications for Car Service Businesses

For car service businesses, GST compliance is crucial. This involves accurately calculating and collecting GST, filing regular returns, and maintaining proper records. Businesses must also understand the nuances of input tax credit, which allows them to offset the GST paid on inputs used in providing their services. For more detailed information on filing GST returns, you can refer to how to file gst3-3b and gstr1 for car services.

Quote from John Smith, Certified Tax Advisor: “Proper GST management is essential for the financial health of any car service business. It ensures legal compliance and helps optimize cash flow.”

Understanding the implications of GST allows businesses to maintain financial stability and avoid penalties for non-compliance.

Why SGST and CGST for Car Service?

In certain countries, GST is divided into State GST (SGST) and Central GST (CGST). why sgcst and cgst for car service will shed more light on this topic. This dual structure ensures that both the state and central governments receive their share of the tax revenue. Understanding the bifurcation of GST into SGST and CGST is essential for accurate accounting and tax filing.

Conclusion

Understanding What Is Gst For Car Service is essential for both consumers and businesses. By grasping the applicable rates, calculation methods, and compliance requirements, everyone involved can ensure a smooth and transparent process. This knowledge empowers consumers to make informed decisions and businesses to operate within the legal framework. If you’re seeking further information on applying GST to car travel services, consider exploring how to gst-3b car travel services videos.

Quote from Jane Doe, Senior Automotive Consultant: “Transparency regarding GST on car services builds trust between service providers and customers.”

FAQs

-

What is the standard GST rate for car services?

-

How do I calculate GST on car repairs?

-

Can I claim input tax credit on car service expenses?

-

What are the GST implications for car dealerships?

-

Where can I find more information on GST regulations for car services?

-

How often do GST rates for car services change?

-

What are the penalties for non-compliance with GST regulations in the car service industry?

Need help with your car service needs? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our 24/7 customer support team is ready to assist you.