Understanding your financial projections is crucial for any business, especially a car service centre. A projected balance sheet, in particular, offers a snapshot of your anticipated financial health at a specific point in the future. This allows you to make informed decisions, secure funding, and effectively manage your car service centre. This guide dives deep into creating a sample of a projected balance sheet for your car service centre.

What is a Projected Balance Sheet and Why is it Important for a Car Service Centre?

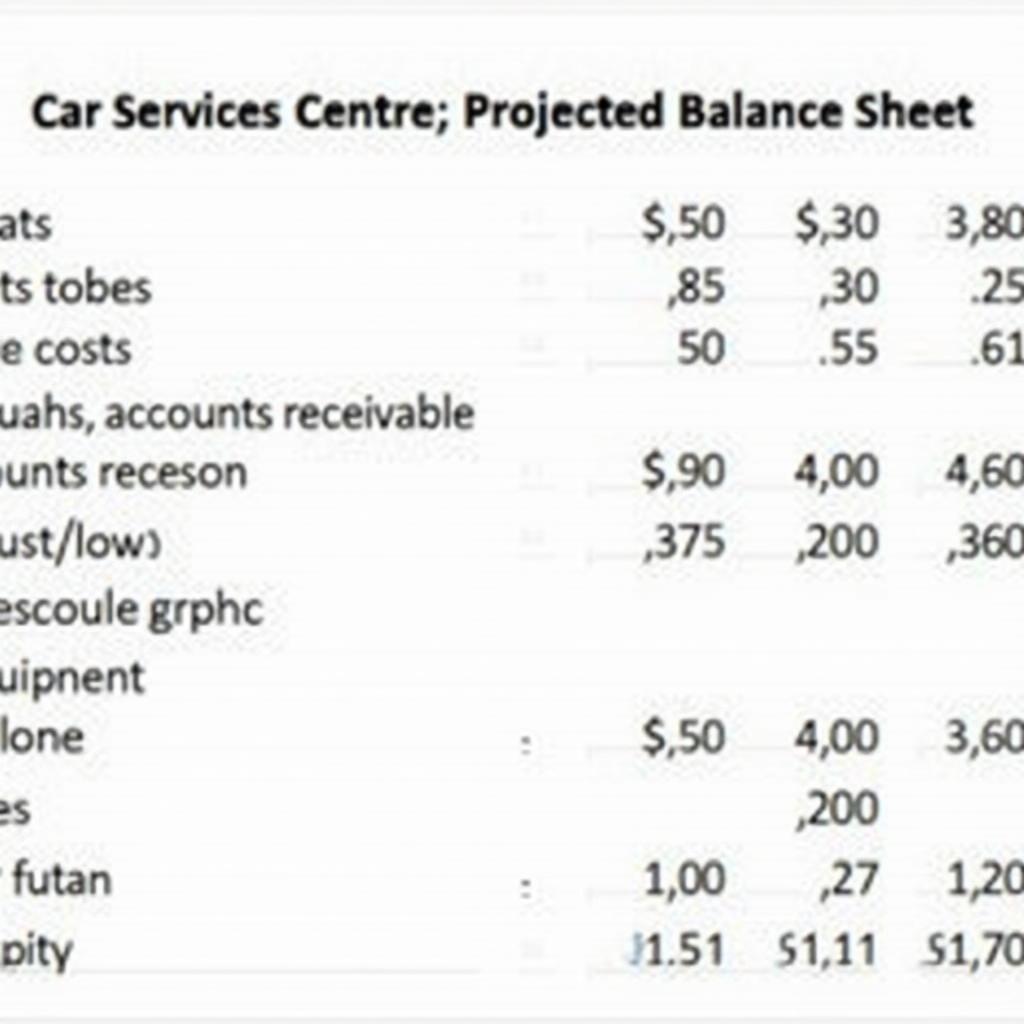

A projected balance sheet, also known as a pro forma balance sheet, estimates your assets, liabilities, and equity at a future date. It’s a vital tool for car service centres as it provides a forward-looking view of financial standing, which helps in planning for growth, identifying potential financial challenges, and attracting investors. It also allows you to strategize your spending and resource allocation within the centre. Essentially, a Sample Of Projected Balance Sheet On Car Service Centre can act as your financial roadmap.

Key Components of a Projected Balance Sheet for a Car Service Centre

A projected balance sheet for a car service centre comprises three core components: assets, liabilities, and equity. Let’s break down each section and its relevance to your car service operations.

Assets: What Your Car Service Centre Owns

Assets represent what your car service centre owns, including tangible items like equipment and intangible assets like goodwill. These are typically categorized into current assets (convertible to cash within a year) and non-current assets (held for longer than a year).

- Current Assets: Cash, accounts receivable (money owed by customers), and inventory (parts and supplies).

- Non-Current Assets: Equipment (lifts, diagnostic tools), land, and buildings.

Liabilities: What Your Car Service Centre Owes

Liabilities represent what your car service centre owes to others. These can be short-term obligations (payable within a year) and long-term obligations (due after a year).

- Current Liabilities: Accounts payable (money owed to suppliers), short-term loans, and salaries payable.

- Long-Term Liabilities: Long-term loans, mortgages.

Equity: The Owner’s Stake in the Car Service Centre

Equity represents the owner’s stake in the car service centre. It’s the residual interest in the assets after deducting liabilities. This section includes retained earnings (accumulated profits) and owner’s contributions.

Creating a Sample Projected Balance Sheet: A Step-by-Step Guide

Creating a projected balance sheet involves forecasting your future financial position based on historical data, market trends, and business assumptions.

- Gather Historical Data: Collect past balance sheets and income statements.

- Project Revenue: Estimate future sales based on market analysis and growth projections.

- Forecast Expenses: Project operating expenses, including salaries, rent, and utilities.

- Estimate Asset Changes: Forecast changes in current and non-current assets based on projected business activity.

- Project Liabilities: Estimate changes in current and long-term liabilities based on financing plans and projected expenses.

- Calculate Projected Equity: Determine the projected equity based on the projected assets and liabilities.

“A well-crafted projected balance sheet provides clarity and direction. It allows car service centre owners to anticipate potential financial roadblocks and navigate towards sustainable growth,” says John Miller, Senior Financial Analyst at Auto Solutions Inc.

Interpreting Your Projected Balance Sheet: Key Metrics and Insights

Analyzing key metrics within your projected balance sheet can provide valuable insights into your car service centre’s financial health. Metrics like the current ratio (current assets / current liabilities) and debt-to-equity ratio (total liabilities / total equity) help assess liquidity and solvency.

“Understanding these metrics is critical for making sound financial decisions. They offer a clear picture of your financial stability and ability to meet obligations,” adds Maria Sanchez, Financial Consultant specializing in automotive businesses.

Conclusion

A sample of projected balance sheet on car service centre is a critical tool for financial planning and management. By projecting your assets, liabilities, and equity, you gain a clear understanding of your centre’s future financial position. This information is invaluable for making informed decisions, attracting investors, and ensuring the long-term success of your car service business.

FAQ

- What is the difference between a projected and actual balance sheet?

- How often should I update my projected balance sheet?

- What are some common mistakes to avoid when creating a projected balance sheet?

- How can I use my projected balance sheet to secure funding?

- What software can I use to create a projected balance sheet?

- How does a projected balance sheet differ for a small versus a large car service centre?

- Where can I find more resources on creating financial projections for my car service centre?

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected]. We have a 24/7 customer support team.