Car Service Itc On Gst is a complex topic that can significantly impact the finances of both car owners and service providers. Understanding how Input Tax Credit (ITC) applies to Goods and Services Tax (GST) on car services is crucial for maximizing benefits and ensuring compliance. This guide delves into the intricacies of car service ITC on GST, providing clarity on eligibility, documentation, and common challenges.

Decoding ITC on Car Service GST

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in India. Input Tax Credit (ITC) allows businesses to reduce their GST liability by claiming credit for the GST paid on inputs used in their operations. However, the applicability of ITC on car service GST is not straightforward and depends on various factors. This can be particularly confusing for businesses that use cars for both personal and business purposes. Understanding the nuances of this system is key to efficient tax management.

Eligibility for ITC on Car Service GST

The eligibility for ITC on car service GST depends primarily on the nature of the car usage. Generally, ITC is available for businesses that use cars for business purposes, such as transportation of goods or employees, or for providing taxable services. However, ITC is generally not available for cars used for personal purposes. Navigating these distinctions is crucial. Are you claiming ITC for services related to a company vehicle used for deliveries? Or is it for your personal car? The answers to these questions determine your eligibility.

Documentation Required for Claiming ITC

To claim ITC on car service GST, businesses must maintain proper documentation, including tax invoices, payment proofs, and vehicle registration details. These documents serve as evidence of the GST paid on the inputs and are crucial for a successful ITC claim. Meticulous record-keeping is paramount for a seamless and hassle-free ITC claim process. Missing or incomplete documentation can lead to delays and potential rejection of your claim.

Common Challenges and Solutions Related to Car Service ITC on GST

Several challenges can arise when claiming ITC on car service GST. One common issue is the mixed usage of cars for both business and personal purposes. In such cases, businesses need to apportion the ITC based on the actual usage for business purposes. Another challenge is the proper classification of car services under the GST framework. Accurate classification is vital for determining the correct GST rate and ITC eligibility.

Understanding the SAC Code for Car Services

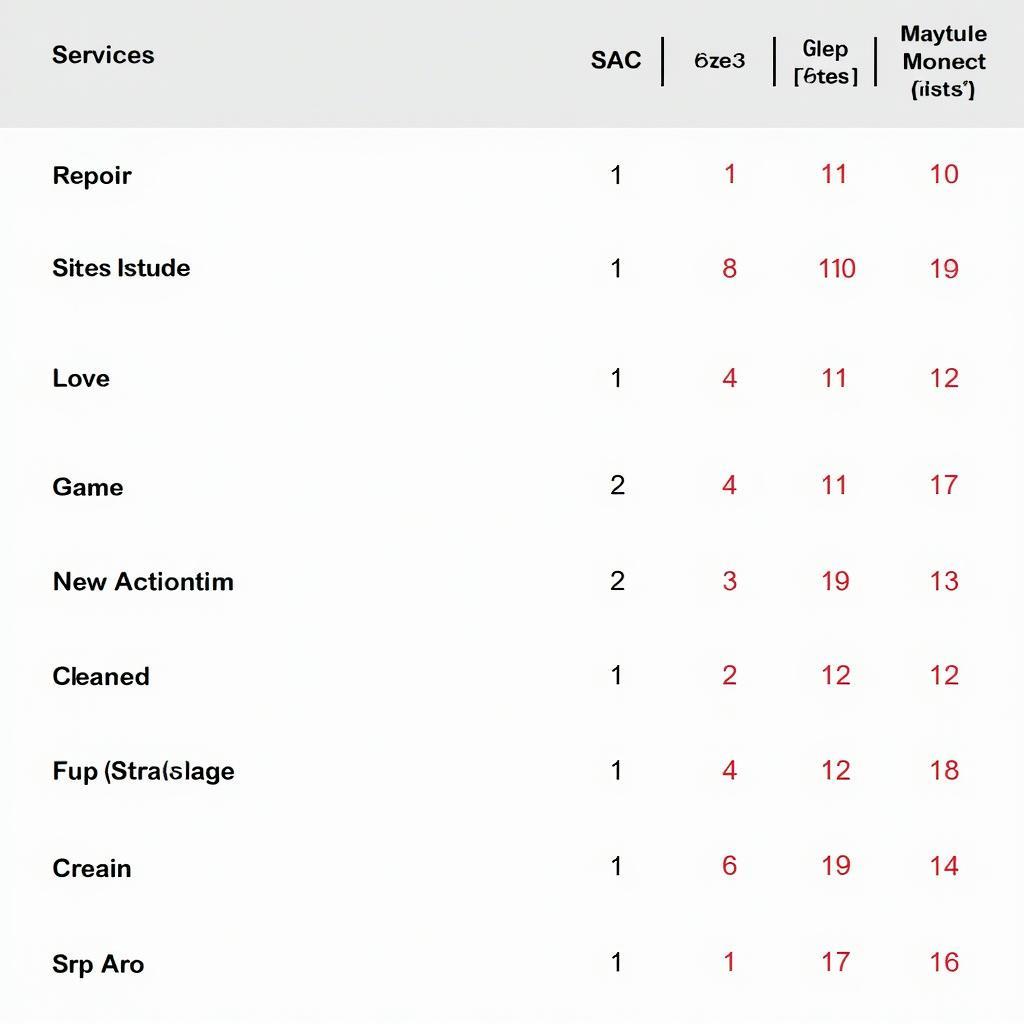

The Services Accounting Code (SAC) is a crucial element in determining the GST rate applicable to car services. The correct SAC code ensures accurate tax calculation and ITC claim. Knowing the specific SAC code for the type of car service you are availing is essential for compliance.

Car Service SAC Code and GST Applicability

Car Service SAC Code and GST Applicability

What if Your Car Servicing is Eligible for ITC Under GST?

Determining whether your car servicing is eligible for ITC under GST involves a careful assessment of your business operations and how the vehicle is utilized. i car servicing eligible for itc under gst provides further insight into this critical aspect. Misinterpreting the guidelines can lead to incorrect ITC claims and potential penalties.

is gst on car service allowes for credit

Cenvat on Motor Car Under Service Tax and its Relevance to GST

Before the implementation of GST, Cenvat credit was available on motor cars under the service tax regime. Understanding the transition from Cenvat to ITC is helpful in comprehending the current GST framework. cenvat on motor car under service tax provides a valuable perspective on this evolution.

car rental service sac code&tax

Conclusion

Car service ITC on GST is a complex but essential aspect of financial management for businesses that use cars for their operations. Understanding the eligibility criteria, documentation requirements, and common challenges can help businesses maximize their ITC benefits and ensure compliance with GST regulations. Properly managing your car service ITC can lead to significant cost savings and smoother business operations.

FAQ

- What is the GST rate on car services?

- How can I claim ITC on car service GST?

- What documents are required for claiming ITC on car service GST?

- What are the common challenges faced while claiming ITC on car service GST?

- What is the SAC code for car services?

- Is ITC available on car services for personal use?

- How can I determine the correct proportion of ITC for mixed-use cars?

For further assistance, please contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer service team is ready to help.