Claiming GST input tax credit on car servicing can be a complex issue, leaving many business owners wondering, “Can We Take Gst Input On Car Servicing?” The answer isn’t always a simple yes or no. It depends on several factors, including how the vehicle is used and the nature of your business. Understanding these nuances is crucial for accurate tax filing and optimizing your business expenses.

Understanding GST Input on Car Servicing

The Goods and Services Tax (GST) is a consumption tax levied on most goods and services sold in many countries. Input Tax Credit (ITC) allows businesses to deduct the GST paid on purchases used for business purposes from the GST they collect on sales. This mechanism avoids double taxation and reduces the overall tax burden on businesses. When it comes to car servicing, claiming ITC can be tricky. The eligibility depends heavily on the vehicle’s usage – is it for personal or business use? This distinction is the cornerstone of determining whether you can claim GST input on car servicing expenses.

can we take gst input of car servicing

When Can You Claim GST Input?

Generally, you can claim GST input on car servicing if the vehicle is exclusively used for business purposes. This means the car is used for transporting goods, providing services, or other activities directly related to your business operations. Examples include delivery vehicles, taxis, and cars used by sales representatives. If the vehicle is used for both personal and business purposes, you can only claim a portion of the GST paid on servicing, proportionate to the business use. Maintaining accurate records of business mileage is essential in such cases.

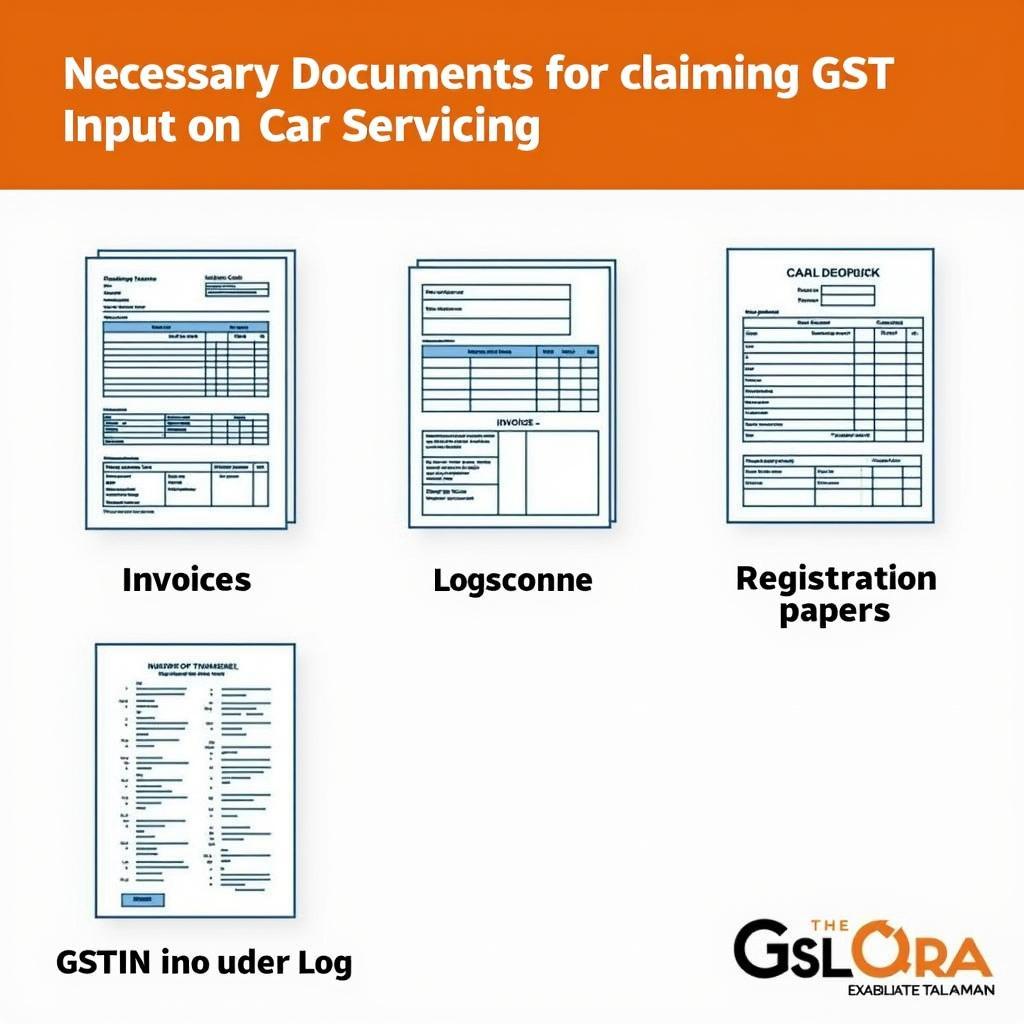

Documentation Required for Claiming GST Input

Proper documentation is vital to support your ITC claim for car servicing. Keep detailed invoices from the service center, clearly outlining the GST component. Also, maintain a logbook recording the date, purpose, and mileage of each business trip. This logbook serves as evidence of business use and justifies your ITC claim.

When Can You Not Claim GST Input?

You cannot claim full GST input on car servicing if the vehicle is primarily used for personal purposes. Even if you occasionally use the car for business errands, the primary use dictates the ITC eligibility. For instance, if you use your personal car to commute to work and occasionally visit clients, you likely won’t be able to claim the full GST paid on servicing. Some countries have specific restrictions on claiming ITC for certain types of vehicles, such as luxury cars or SUVs, even if they are used for business purposes.

Common Misconceptions about GST Input on Car Servicing

A common misconception is that simply registering the vehicle under the business name automatically qualifies you for full ITC on car servicing. This is not necessarily true. The actual usage of the vehicle is the determining factor. Another misconception is that leasing a car always allows for full ITC claims. While leasing often offers more favorable tax treatment than purchasing, the ITC eligibility still depends on the vehicle’s usage.

Expert Insights

“Understanding the nuances of GST input on car servicing can significantly impact a business’s bottom line,” says John Smith, a Senior Tax Consultant at TaxPro Solutions. “Accurate record-keeping is crucial to ensure compliance and maximize tax benefits.”

can we take gst input of car servicing

Maximizing Your GST Benefits

To maximize your GST benefits related to car servicing, meticulously track your vehicle usage and maintain comprehensive records. Consult with a qualified tax advisor to understand the specific regulations in your region and ensure you are complying with all applicable laws. They can help you develop a strategy for maximizing your ITC claims while staying compliant.

Conclusion

So, can we take GST input on car servicing? The answer depends on the specifics of your situation. By understanding the rules and regulations, maintaining accurate records, and seeking professional advice when needed, you can effectively manage your car servicing expenses and optimize your GST benefits. Remember, accurate record-keeping is key to a smooth tax filing process and avoiding potential penalties.

FAQ

- What is GST input?

- How do I calculate the proportionate GST input for mixed-use vehicles?

- What records do I need to maintain for claiming GST input on car servicing?

- Can I claim GST input on car servicing for a leased vehicle?

- Are there any specific vehicle types ineligible for GST input claims?

- What are the penalties for incorrect GST input claims?

- Where can I get more information on GST regulations for car servicing?

Need Help?

For personalized guidance on GST input for car servicing and other car diagnostic solutions, contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer support team is ready to assist you.