Car Rent Service Gst Rate is a crucial aspect to consider when budgeting for your next trip or business travel. Knowing how GST applies to car rentals can help you avoid unexpected costs and make informed decisions. This article will delve into the specifics of GST on car rentals, helping you understand the current rates, exemptions, and how it impacts your overall expenses. We’ll also explore how these rates vary based on the type of vehicle rented and the purpose of the rental.

Decoding the GST on Car Rental Services

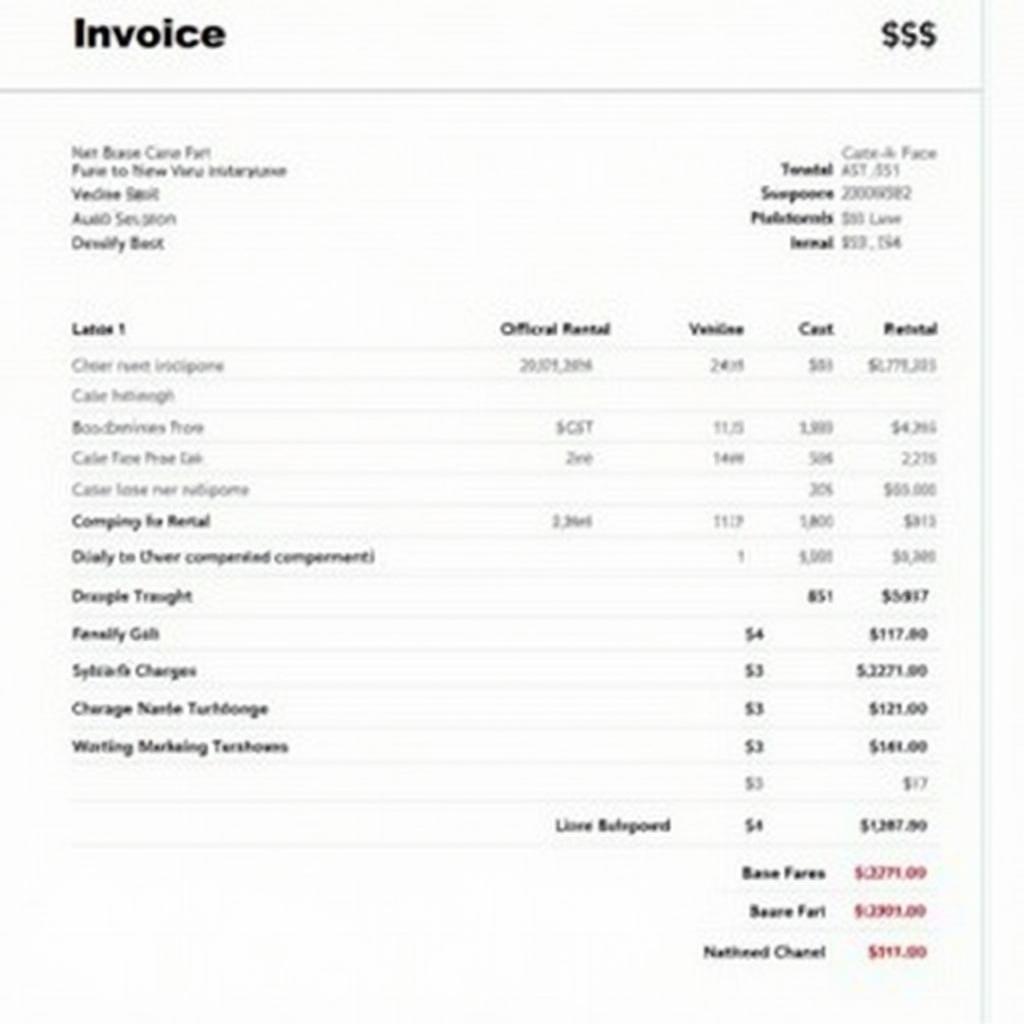

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services in many countries, including India. For car rental services, the GST rate is generally 18%. This means that 18% of the base fare of your car rental will be added as GST. However, there can be variations depending on specific factors like the type of vehicle and additional services included in the rental agreement. Understanding these nuances is essential for accurate budgeting.

Understanding the GST implications of renting a car isn’t just about knowing the percentage; it’s also about knowing what’s included and what’s exempt. For instance, some components of the rental cost, like insurance or tolls, might be treated differently under GST regulations. Let’s explore these details further to gain a comprehensive understanding.

Factors Influencing Car Rent Service GST Rate

Several factors can influence the final GST rate applied to your car rental. The type of vehicle plays a significant role. Luxury cars, SUVs, and larger vehicles may attract a higher GST rate compared to standard sedans or hatchbacks. Additionally, add-on services like chauffeur services or GPS rentals might have separate GST implications.

Furthermore, the purpose of the rental can also influence the GST rate. For example, rentals for business purposes may have different GST implications than personal rentals, particularly regarding input tax credit claims. Businesses might be able to claim input tax credit on the GST paid for car rentals used for business activities, reducing their overall tax burden. You can learn more about input tax credit on services like can you claim input credit on service of motor car.

What is the current GST rate for car rental services?

Currently, the standard GST rate applicable to car rental services is 18%.

Are there any exemptions to the GST on car rentals?

While the standard rate is 18%, exemptions might apply in certain specific circumstances. It’s always recommended to consult with the rental agency for the latest information on GST applicability and any potential exemptions.

How does GST affect my total car rental cost?

GST adds 18% to the base fare of your car rental. For instance, if the base fare is $100, the GST will be $18, making the total cost $118.

Car Rental GST: Business vs. Personal Use

For businesses, understanding the GST implications is particularly important. If you’re renting a car for business use, you might be eligible to claim input tax credit on the GST paid, effectively reducing your overall tax liability. However, this is subject to specific conditions and regulations. For personal rentals, the GST is simply added to the total cost. Services like jaipur car rental hire services may provide detailed information related to their GST policies.

Conclusion

Navigating the car rent service GST rate can seem complex, but by understanding the basics and considering the factors that influence the rate, you can budget effectively and avoid surprises. Always check with the car rental agency for the latest information on GST rates and any applicable exemptions. This proactive approach will ensure a smoother and more transparent rental experience. You might also find useful information related to other services, such as service charge for car audio hsn code.

FAQ

-

What is the standard GST rate for car rentals?

- The standard GST rate is 18%.

-

Can I claim input tax credit on car rentals?

- Businesses might be eligible to claim input tax credit for business-related car rentals, subject to specific regulations.

-

Are there any GST exemptions for car rentals?

- Exemptions might apply in specific circumstances. Consult the rental agency for more information.

-

How is GST calculated on car rentals?

- GST is calculated as 18% of the base fare.

-

What factors influence the car rental GST rate?

- Factors include the type of vehicle, additional services, and the purpose of the rental.

-

Where can I find the most up-to-date GST rates for car rentals?

- Contact the car rental agency directly for the most current information.

-

How can I plan my budget considering the GST on car rentals?

- Factor in 18% of the base fare as GST to accurately estimate the total rental cost.

Need assistance? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer service team is available 24/7.