When it comes to managing your finances, especially for business owners, understanding tax implications is crucial. If you’re wondering, “Can I claim GST input on car service charges?” you’ve come to the right place. This article dives into the intricacies of GST input credits related to car servicing in Australia, equipping you with the knowledge to make informed financial decisions.

Decoding GST and Input Tax Credits

Before we delve into the specifics of car servicing, let’s clarify the fundamentals of GST and input tax credits.

Goods and Services Tax (GST): A broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia.

Input Tax Credits: If your business is registered for GST, you can generally claim credits for the GST included in the price of goods and services you purchase for your business. This essentially means you can offset the GST you’ve paid on business expenses against the GST you collect from your customers.

Car Servicing and GST: The Key Considerations

Now, let’s address the core question: is GST input claimable on car servicing? The answer is – it depends. Here’s a breakdown of the key factors:

- Business Use Versus Private Use: The primary determinant is whether the car is used solely for business purposes, exclusively for private purposes, or a combination of both.

- Extent of Business Use: If the vehicle is used for both business and private purposes, you can only claim GST credits for the portion attributable to business use. This necessitates meticulous record-keeping of your mileage, using methods like logbooks or electronic tracking systems.

- Type of Vehicle: The type of vehicle can influence your GST entitlement. For instance, certain vehicles, like those primarily designed to carry passengers, might have limitations on GST input tax credit claims.

Maximizing Your GST Input Tax Credits

To ensure you’re claiming the maximum allowable GST credits for your car servicing expenses, consider these strategies:

- Accurate Record-Keeping: Maintain meticulous records of all your car-related expenses, including servicing, fuel, and repairs. This documentation is essential for substantiating your claims, especially if you’re audited by the Australian Taxation Office (ATO).

- Seek Professional Advice: Consulting with a qualified tax advisor or accountant is invaluable. They can provide tailored guidance based on your specific circumstances, ensuring you’re claiming all eligible deductions and credits while remaining compliant with tax regulations.

Common Car Servicing Expenses and GST

Here’s a closer look at common car servicing expenses and their GST implications:

- Regular Servicing: Costs associated with routine maintenance, such as oil changes, filter replacements, and safety checks, are generally eligible for GST credits if the vehicle is used for business purposes.

- Repairs: Similar to servicing, repairs deemed necessary for the operation of your business vehicle are usually GST creditable.

- Tyres: The GST paid on new tyres for your business vehicle is generally claimable. However, there might be limitations based on factors like the type of vehicle and its use.

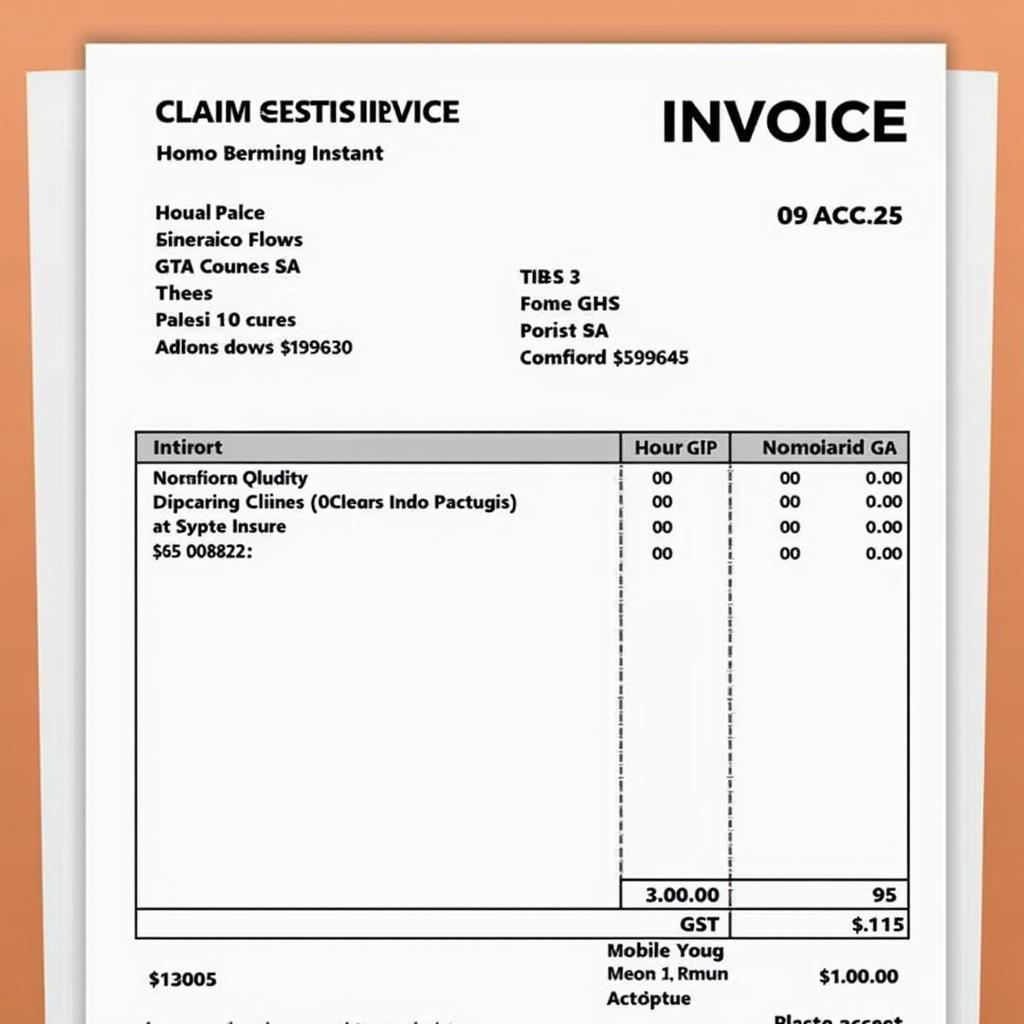

Car Service Invoice with GST Breakdown

Car Service Invoice with GST Breakdown

Navigating GST and Car Servicing: Frequently Asked Questions

1. Can I claim GST on car servicing if I use the simplified depreciation rules for my vehicle?

Yes, you can still claim GST credits for car servicing even if you use the simplified depreciation rules. These rules primarily affect how you depreciate the vehicle’s cost, not your ability to claim GST on related expenses.

2. What if I only use my car for business purposes occasionally?

If your business use is minimal, claiming GST credits might not be worthwhile due to the record-keeping requirements. Consult with a tax professional to determine the best approach in your situation.

3. I’m a sole trader. Can I still claim GST input tax credits for car servicing?

Yes, as long as you’re registered for GST and the car is predominantly used for business purposes, you can claim GST credits as a sole trader.

4. What happens if I don’t keep proper records of my car’s business use?

Failure to maintain accurate records can lead to your GST claims being denied by the ATO. It’s crucial to keep detailed logs or use tracking systems to substantiate your claims.

5. Where can I find more information about GST and car servicing?

The ATO website provides comprehensive information on GST and its application to motor vehicle expenses. You can also contact the ATO directly or consult with a qualified tax advisor.

Conclusion

Navigating the intricacies of GST and car servicing can seem daunting, but understanding the rules is essential for business owners. By keeping accurate records and seeking professional advice when needed, you can confidently optimize your GST claims and ensure compliance with Australian tax regulations.

Need more guidance on claiming GST input tax credits on your car service charges? Check out our article on can itc be claimed on car service charges for further insights.

Have additional questions or require assistance with your car servicing needs? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our dedicated customer support team is available 24/7 to assist you.