When you take your car in for a service, you’re likely focused on getting your vehicle back in tip-top shape. But have you ever wondered about the breakdown of the final bill, particularly the GST charge? Understanding GST on car service is crucial for both car owners and businesses in the automotive industry.

Decoding GST in Car Service

GST, or Goods and Services Tax, is a consumption tax levied on most goods and services sold in many countries, including Australia, Canada, and India. In the context of car service, GST applies to the labor charges and any parts used during the service.

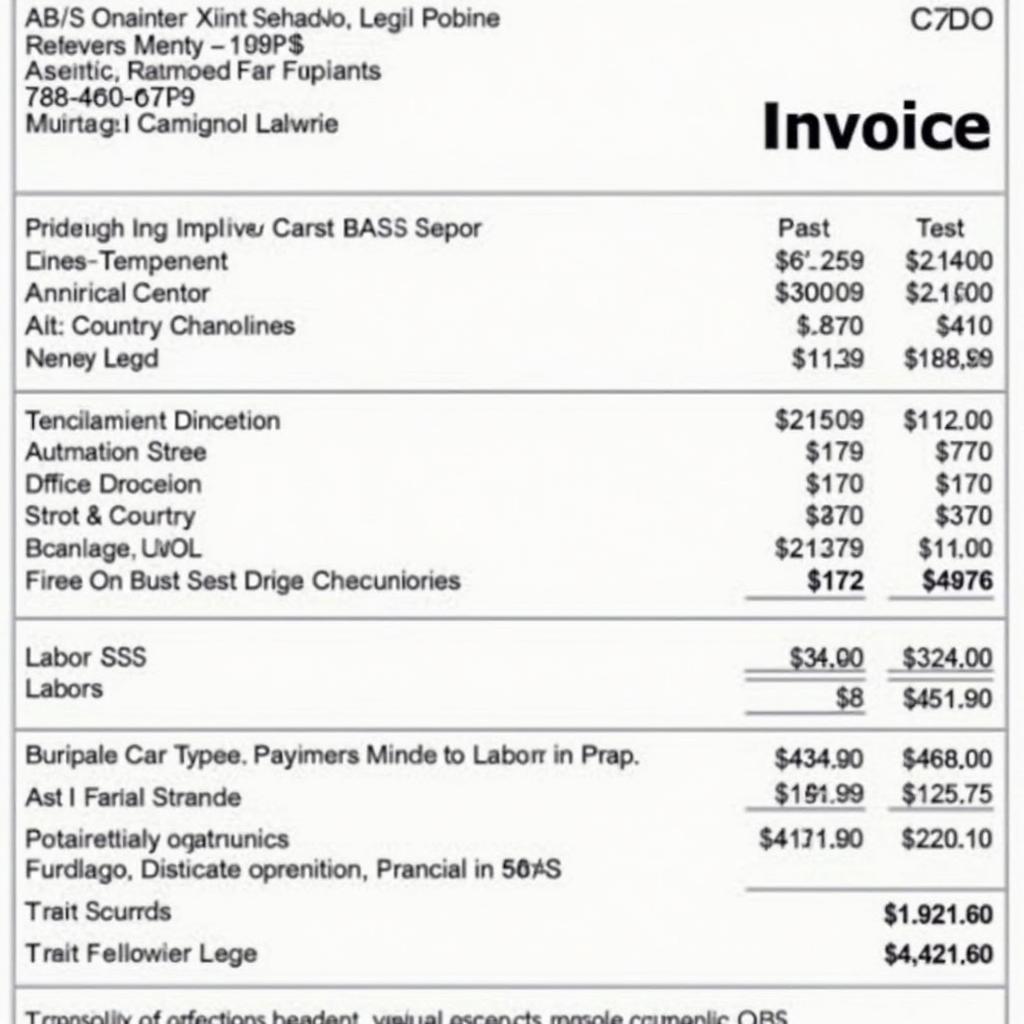

Car service invoice showing GST charges

Car service invoice showing GST charges

How Much GST is Applied to Car Service?

The GST rate for car service can vary depending on your location and the specific services rendered. For instance, in Australia, a flat 10% GST applies to most car services. However, it’s always best to confirm the current GST rate with your mechanic or refer to your local tax authority’s guidelines.

“GST can significantly impact the overall cost of car maintenance,” says John Smith, Senior Automotive Technician at ABC Mechanics. “It’s important for car owners to factor in this tax when budgeting for their vehicle’s upkeep.”

What Services Attract GST?

Generally, most car service and repair tasks are subject to GST. This includes but isn’t limited to:

- Routine Maintenance: Oil changes, filter replacements, tire rotations, and other standard maintenance procedures.

- Mechanical Repairs: Engine work, brake repairs, suspension fixes, and other mechanical repairs.

- Electrical System Repairs: Diagnosing and fixing issues with the car’s electrical components.

- Bodywork: Dent repairs, paint jobs, and other cosmetic fixes.

Are There Any Exemptions?

While GST applies to most car services, some exemptions might exist. For example, certain charitable organizations or specific vehicle types might be eligible for GST exemptions or reduced rates. It’s essential to check with your local tax authorities or a tax professional for a comprehensive understanding of potential exemptions.

Can I Claim GST on Car Service Charges?

Whether you can claim GST on your car service depends on several factors, such as your location, the purpose of the vehicle (business or personal use), and specific regulations. If you’re using your vehicle for business purposes, you might be eligible to claim GST credits for the tax paid on your car service expenses.

For more detailed information on claiming GST for car service charges, refer to our dedicated article: can itc be claimed on car service charges.

How Much is GST on a Car Service?

To determine the exact GST amount on your car service, you can refer to your invoice. It will typically itemize the labor costs, parts expenses, and the GST applied to each.

If you’re looking for a quick estimate of the GST you might incur, you can use online GST calculators or consult our comprehensive guide: how much is gst on a car service.

“Always review your car service invoice carefully to ensure the GST charges are accurate,” advises Smith. “Don’t hesitate to ask your mechanic for clarification if you have any questions about the breakdown.”

Conclusion

Understanding the GST charge in Car Service is crucial for managing your vehicle maintenance budget effectively. By being aware of the applicable GST rates, exemptions, and potential claims, you can make informed decisions about your Car Service needs. Remember to consult with tax professionals or your local tax authority for specific advice tailored to your circumstances.

Leave a Reply