Managing car service finances efficiently is crucial for any business, and Tally ERP 9 offers a robust solution for this. Understanding how to correctly enter car service transactions in Tally ensures accurate accounting, simplifies tax filing, and provides valuable insights into your business expenses. This guide provides a detailed walkthrough of the process, covering everything from basic entries to advanced configurations.

Recording Car Service Expenses in Tally ERP 9

Tally allows you to meticulously track every car service expense, ensuring transparency and accuracy. Here’s a step-by-step guide to recording these transactions:

-

Create a Ledger for Car Service Expenses: Navigate to the “Gateway of Tally” > “Accounts Info.” > “Ledgers” > “Create.” Under the “Name” field, enter “Car Service Expenses.” Select the appropriate group (usually “Indirect Expenses”).

-

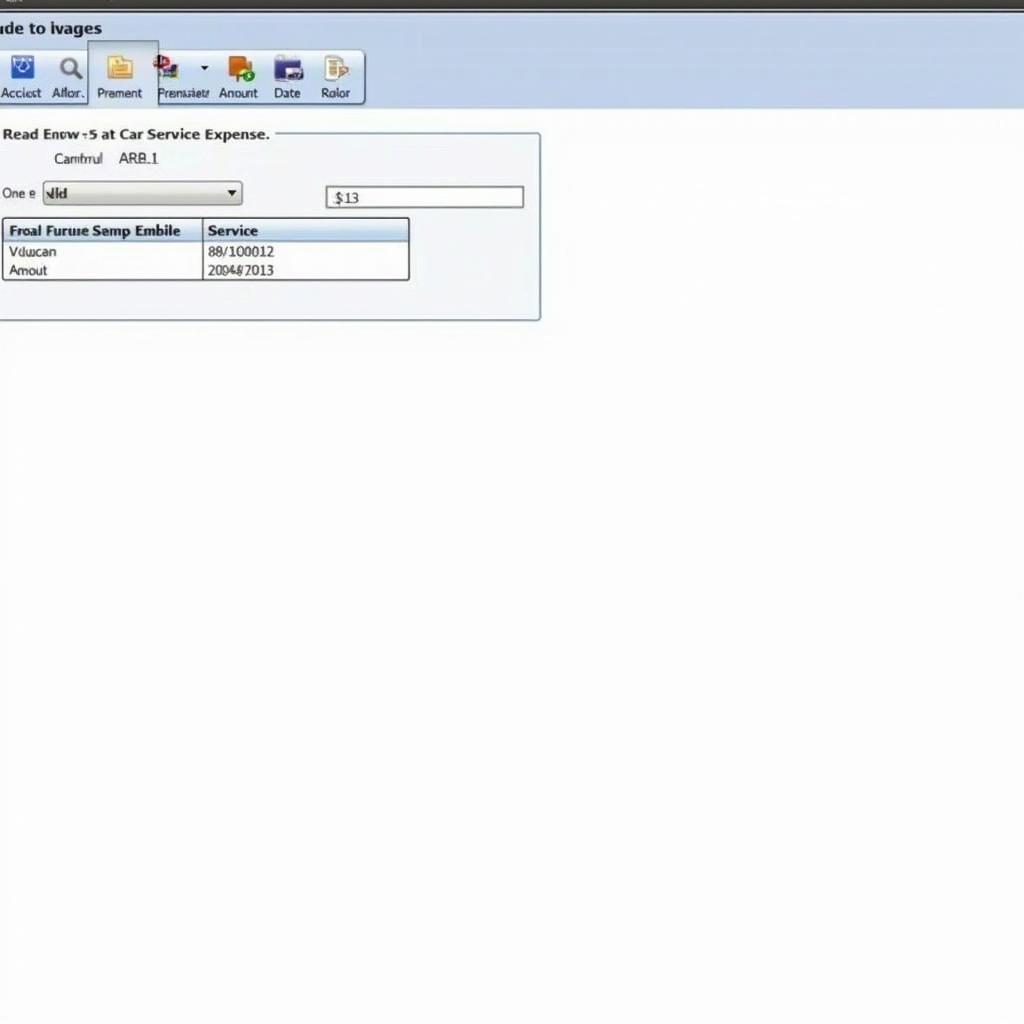

Record the Voucher Entry: Go to “Gateway of Tally” > “Accounting Vouchers.” Select the appropriate voucher type (usually “Payment” or “Journal,” depending on the transaction).

-

Enter the Transaction Details: In the voucher entry screen, select the “Car Service Expenses” ledger you created. Enter the amount of the expense, the date of the service, and any other relevant details. You can also specify the vehicle number or other identifying information in the “Narration” field.

-

Save the Voucher: Once you’ve entered all the necessary information, press “Enter” to save the voucher.

This process ensures that all your car service expenses are properly recorded and categorized within Tally, simplifying your accounting and reporting processes.

Advanced Configurations for Car Service Entries in Tally

Tally’s flexibility allows for more detailed tracking of car service expenses. Consider these advanced configurations:

-

Creating Separate Ledgers for Different Types of Car Services: You can create separate ledgers for different types of car services, such as “Fuel,” “Repairs,” “Maintenance,” and “Insurance.” This provides a more granular view of your expenses.

-

Tracking Expenses by Vehicle: If you manage multiple vehicles, create separate ledgers for each vehicle. This allows you to analyze expenses on a per-vehicle basis.

-

Using Cost Centers: Cost centers can be used to track car service expenses by department or project. This is particularly useful for businesses that use vehicles for specific projects.

Utilizing Tally Reports for Car Service Expense Analysis

Tally generates various reports that provide valuable insights into your car service expenses. These reports can be used to identify trends, track budgets, and make informed decisions.

-

Day Book: The Day Book provides a chronological list of all transactions, including car service expenses.

-

Profit & Loss Account: This report shows the overall profitability of your business, including the impact of car service expenses.

-

Trial Balance: The Trial Balance helps ensure the accuracy of your accounting by showing the balance of all ledgers.

By leveraging these reports, you can effectively manage your car service expenses and optimize your business operations. Similar to car service expenses, analyzing your spending patterns can reveal opportunities for cost savings.

Why Accurate Car Service Entries are Important

Accurate car service entries in Tally are crucial for several reasons:

-

Accurate Financial Reporting: Accurate entries ensure that your financial statements reflect the true cost of running your business.

-

Simplified Tax Filing: Properly categorized expenses simplify tax filing and help you claim eligible deductions.

-

Better Budgeting and Forecasting: Tracking expenses helps you create realistic budgets and forecast future spending.

-

Improved Decision-Making: Data-driven insights enable you to make informed decisions about vehicle maintenance, replacement, and overall fleet management. Much like a car service voucher can provide a detailed breakdown of services, meticulous record-keeping in Tally offers a comprehensive view of your expenditures.

Conclusion

Accurate and detailed “car services entry in tally” is vital for effective financial management. By following the steps outlined in this guide and utilizing Tally’s advanced features, you can streamline your accounting processes, improve financial reporting, and gain valuable insights into your car service expenses. This will ultimately contribute to better decision-making and increased profitability. This reminds us of the detailed service records you might find in areas known for excellent car care, such as hyderabad best car service centers. Remember, proper financial management is key to the success of any car service business.

FAQs

-

What voucher type should I use for car service entries? Typically, “Payment” or “Journal” vouchers are used.

-

Can I track fuel expenses separately? Yes, create a separate ledger for “Fuel Expenses.”

-

How can I generate reports on car service expenses? Navigate to the “Gateway of Tally” > “Display” > “Statements of Accounts” and choose the desired report. The process is similar when looking up specific details like a tally erp 9 enrty in car services bill.

-

What are cost centers and how can I use them? Cost centers allow you to categorize expenses by department or project.

-

Is it necessary to create separate ledgers for each vehicle? It’s highly recommended, especially if you manage multiple vehicles. It provides more granular data for analysis, much like the detailed information you’d expect from a reputable car service kew.

-

How can I customize the narration field? You can add any relevant information, such as the vehicle number or type of service.

-

Can I import car service expenses from other software into Tally? Yes, Tally allows data import from various formats.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected]. Our customer service team is available 24/7.