Managing car service expenses effectively is crucial for any business, especially those heavily reliant on transportation. Accurate accounting of these costs provides valuable insights into operational efficiency and profitability. This article provides a comprehensive guide on how to efficiently record car service expenses in Tally, ensuring accurate financial reporting and informed decision-making. We’ll delve into the specifics of “Car Service Expenses Entry In Tally”, simplifying the process for both beginners and seasoned users. Learn how to categorize, track, and analyze these expenses for better financial control.

Tracking car service expenses can feel overwhelming, but using Tally simplifies the process significantly. Accurate entries are vital for sound financial management, enabling you to make informed decisions based on real-time data. We’ll cover everything from basic data entry to advanced reporting techniques. Are you ready to streamline your car service expense management? Let’s dive in! You might also be interested in our guide on extended car service plan.

Understanding Car Service Expenses in Tally

Car service expenses encompass a range of costs associated with maintaining and operating vehicles. These can include routine maintenance like oil changes and tire rotations, repairs due to wear and tear or accidents, fuel costs, insurance premiums, and even parking fees. Properly categorizing these expenses within Tally is essential for accurate reporting and analysis. This not only simplifies tax filing but also allows businesses to identify areas for potential cost savings.

Accurately recording these expenses in Tally ensures your financial statements reflect the true cost of running your fleet. This is especially important for businesses offering services like wedding car services near me. Misclassifying or omitting expenses can lead to inaccurate financial reporting and skewed business decisions.

Step-by-Step Guide: Car Service Expenses Entry in Tally

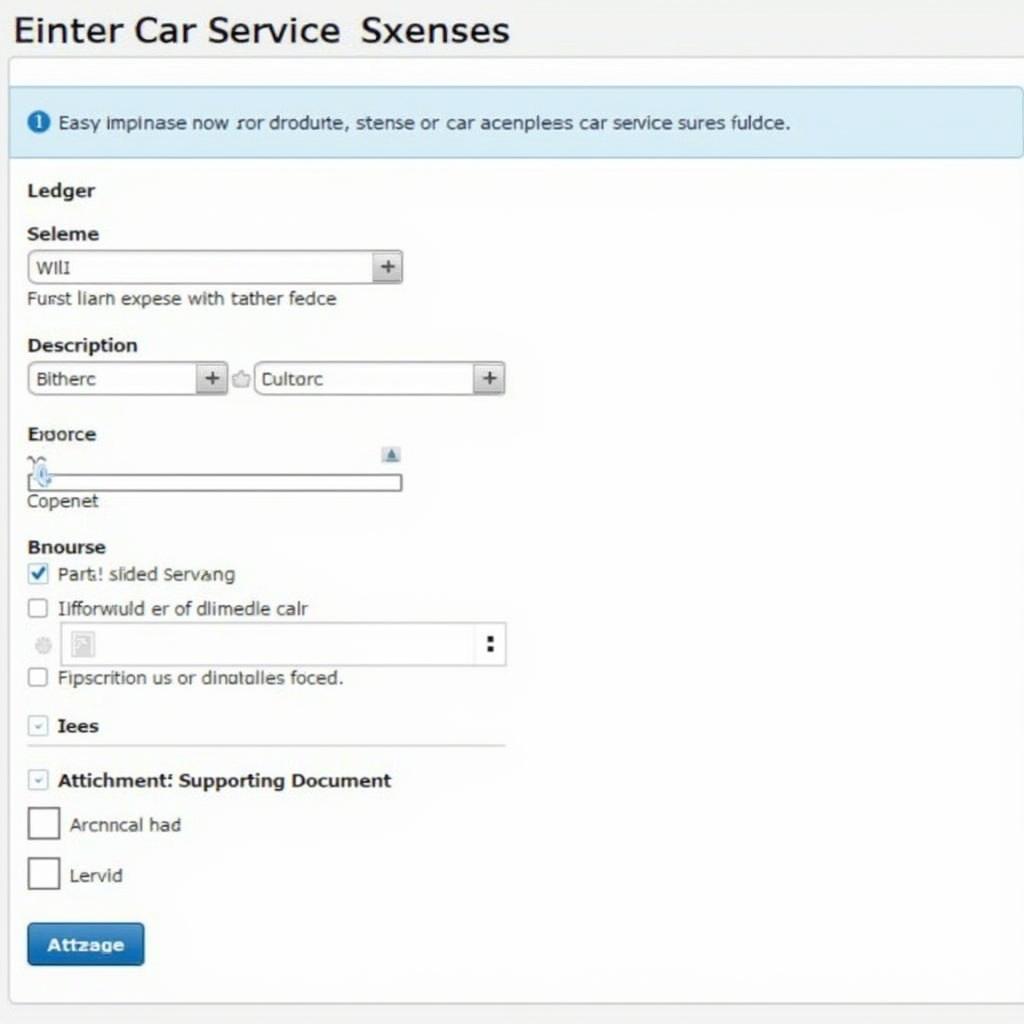

Here’s a practical guide to entering car service expenses in Tally:

- Create a Ledger: Establish a dedicated ledger for “Car Service Expenses” under the appropriate group (Indirect Expenses).

- Record the Voucher: Use a payment voucher to record the expense. Enter the date, supplier name, and the amount spent.

- Categorize the Expense: Select the “Car Service Expenses” ledger you created earlier.

- Add Details: Include a detailed description of the service performed (e.g., “Oil Change,” “Brake Repair”). This adds clarity and allows for detailed analysis later.

- Attach Supporting Documents: Attach scanned copies of invoices, receipts, or other relevant documents for future reference and audit trails.

This structured approach ensures consistent and accurate record-keeping, simplifying financial management. Remember, accuracy is key.

Analyzing Car Service Expenses in Tally

Tally provides robust reporting features that enable you to analyze car service expenses effectively. You can generate reports to track expenses by category, vehicle, or time period. This data-driven approach helps identify trends, pinpoint cost drivers, and make informed decisions to optimize fleet management. For instance, if you notice a consistent increase in fuel expenses, you might consider implementing fuel-efficient driving practices or exploring alternative fuel options.

Understanding your expenses allows you to identify areas for improvement. Are your maintenance costs too high? Perhaps a preventative maintenance schedule could reduce unexpected repairs. These insights are invaluable for businesses operating in competitive markets like those offering the best car service in hyderabad.

Tips for Efficient Car Service Expense Management in Tally

- Regular Reconciliation: Regularly reconcile your Tally entries with bank statements and invoices to ensure accuracy.

- Utilize Cost Centers: If you manage multiple vehicles, use cost centers in Tally to track expenses for each vehicle separately.

- Automate Data Entry: Explore options for automating data entry to save time and minimize errors.

By following these tips, you can streamline your accounting processes and gain valuable insights into your car service expenditures.

Common Challenges and Solutions

One common challenge is accurately categorizing expenses. Ensure you have a clear understanding of the different expense categories in Tally and consistently apply them. Another issue might be missing documentation. Establish a system for collecting and storing receipts and invoices.

“Accurate expense tracking is fundamental to understanding profitability. Don’t underestimate the power of data-driven insights.” – John Smith, Certified Public Accountant

Conclusion

Effectively managing car service expenses is crucial for any business that relies on vehicles. By leveraging Tally’s features and following best practices, you can streamline the process, ensuring accurate financial reporting and informed decision-making. Mastering “car service expenses entry in Tally” empowers you to gain control over your fleet costs and optimize your operations for greater profitability. Remember to consult resources like the one on service tax rate on car hire charges for comprehensive information.

FAQs

- What is a ledger in Tally? A ledger is an account used to classify and store financial transactions.

- What type of voucher should I use for car service expenses? A payment voucher is typically used.

- Can I track expenses for individual vehicles in Tally? Yes, by using cost centers.

- How can I generate reports on car service expenses? Use Tally’s reporting features to create customized reports.

- What supporting documents should I attach? Invoices, receipts, and any other relevant documentation.

- How can I ensure the accuracy of my entries? Regularly reconcile your Tally entries with bank statements and invoices.

- Where can I find more information about Tally? Tally’s official website and various online forums offer extensive resources.

Car Service Expenses Entry Scenarios

- Regular Maintenance: Create recurring entries for routine services like oil changes.

- Unexpected Repairs: Record these as separate entries with detailed descriptions.

- Fuel Expenses: Track fuel purchases using separate ledgers or cost centers for each vehicle.

Related Resources

Check out these helpful resources: i10 car service ny.

Need assistance with your car diagnostics? Contact us via WhatsApp: +1(641)206-8880 or email: [email protected]. Our 24/7 customer support team is always ready to help.